NCB and Go Vap Business Association provide exceptional financial solutions to corporate customers

The National Citizen Commercial Joint Stock Bank (NCB) has collaborated with the Go Vap Business Association to disseminate information regarding the bank's products and services to businesses via the mini app "Developing with Go Vap District Businesses" on the Zalo messaging platform.

The Go Vap Business Association has introduced the application "Developing with Go Vap District Businesses," which serves as a valuable and comprehensive information platform for trade and investment promotion policies, business networking events, employment opportunities in the district, and more. This is a secure and contemporary technological solution that provides businesses with precise and rapid information, actively fostering developmental momentum for enterprises in the region. Numerous initiatives and support policies from NCB for enterprises and business households in the district will be implemented directly via the mini app through collaboration. Consequently, businesses and commercial households in Go Vap district, Ho Chi Minh City, can readily explore practical banking products and services tailored to their requirements, along with appealing incentives to support their operations, optimize benefits, and improve the experience for business customers.

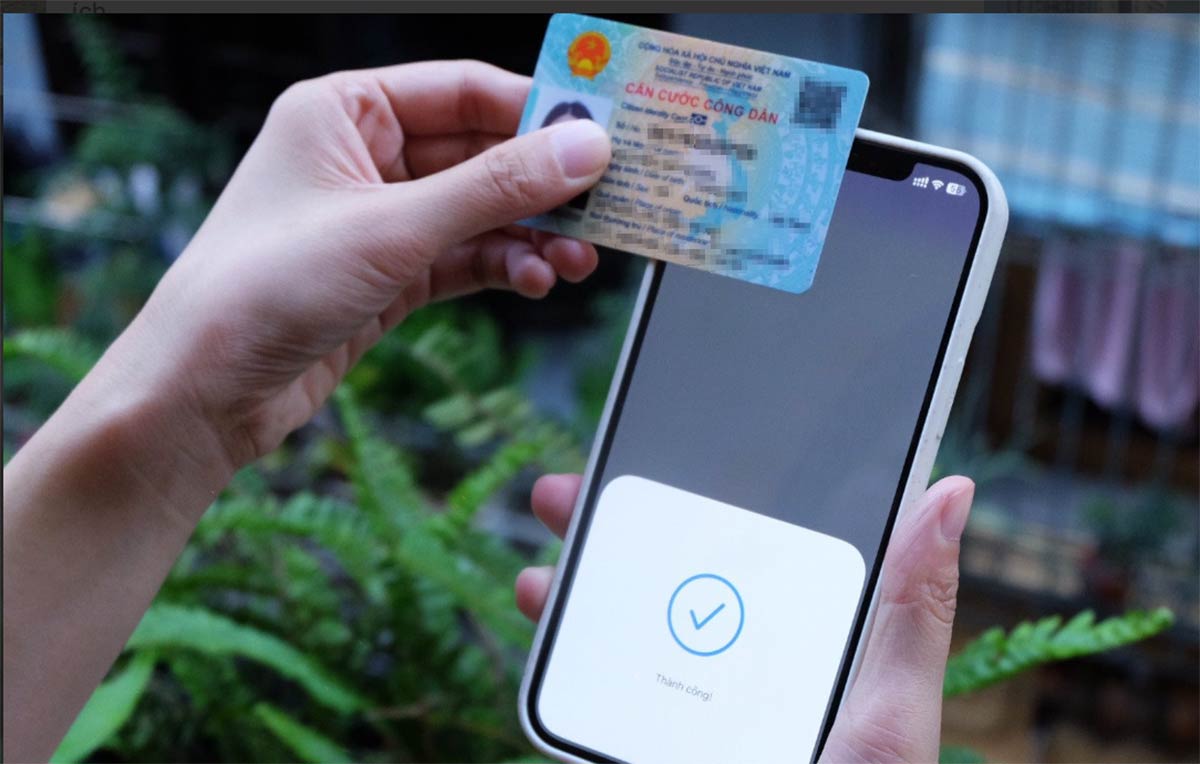

By following a few straightforward steps: Access the Mini app "Developing with Go Vap District Businesses," navigate to the Bank Connection section, choose NCB, and click on the product icon. Businesses and business households in the district can proactively explore NCB's exceptional products and services or engage with bank personnel for assistance. NCB specifically assists businesses by providing rapid and efficient finance sources to facilitate manufacturing and business expansion through streamlined processes. Businesses requiring loans can simply access and complete the online loan application form, eliminating the requirement for extensive time spent running or visiting a bank branch or transaction office.

This initiative represents NCB's commitment to enhancing and digitizing products and services for business customers, positioning them as beneficiaries of the digital transformation strategy while aligning with market development trends.

Previously, NCB launched the NCB iziBankbiz digital banking application, enabling users to function seamlessly across all devices, facilitating the digitization of financial management for enterprises, alleviating operational resource burdens, and fostering business growth.

Simultaneously, the bank augmented the utilization of financial instruments, accompanied by varied and pragmatic incentives, enhancing confidence and fostering greater motivation within the business community. NCB's customized solutions, ranging from broad to specialized, are increasingly trusted and selected by organizations engaged in production, commercial development, and international cooperation. Examples include financing products for distributors in the fast-moving consumer goods sector, unsecured loans up to VND 10 billion; credit solutions for businesses executing bidding packages funded by the state budget or ODA; and a flat-rate money transfer program that enables businesses to reduce costs while streamlining the international transaction process.

Through these comprehensive and practical financial solutions, NCB provides comprehensive and practical financial solutions that enable businesses to navigate challenges, ensuring a seamless and cohesive production and operational flow, while also demonstrating the bank's active support and strong affiliation with the Vietnamese business community.

NCB stated that in the future, the bank will persist in offering financial solutions closely aligned with the life and growth of enterprises, collaborating with major partners to further digital transformation. This enhances corporate customer experiences and increases community value.